Tag Archives: in-house debt collection

What the holiday season means for credit

The holiday season is quickly approaching and that means it will soon be the busiest season of the year for many of your clients. Most businesses are preparing for the influx of sales from Black Friday, Cyber Monday and the end of Q4 leading up to major gift-giving holidays like Christmas and Hanukah. As Holiday shopping ramps up, businesses have been increasing their inventory dramatically.

What does this mean for you?

While this may not apply to the service-side business customers, your retail customers are most likely investing a significant amount of money right now in the months leading up to the holiday season. By growing their product stock for the holiday rush, they will be looking to negotiate more flexible payment terms or delay their payment to account for the pre-season costs.

What should you do?

While these businesses may be strapped for cash leading up to November and December, it won’t last long. Once shoppers head out to make their holiday purchases, your customers will have plenty of cash on hand to pay  off outstanding debt. The one problem is you are not the only person trying to get paid. This means you need to assert yourself as someone they will want to prioritize. The goal is to get on your delinquent customer’s payment schedule. Make your business a priority so that you receive payment between November 15 and December 15. Chasing the debt after December 15 will be unsuccessful because many employees will be away for the holidays and it will be significantly easier to push payment off until the beginning of the year.

off outstanding debt. The one problem is you are not the only person trying to get paid. This means you need to assert yourself as someone they will want to prioritize. The goal is to get on your delinquent customer’s payment schedule. Make your business a priority so that you receive payment between November 15 and December 15. Chasing the debt after December 15 will be unsuccessful because many employees will be away for the holidays and it will be significantly easier to push payment off until the beginning of the year.

If you are in the middle of a debt collection campaign, emphasize the importance of paying the debt when there is an influx of cash flow. Check with your sales team to see when they last visited the delinquent customer . They most likely will have an insider insight to their stock levels and current order quantity. Remember to always do your research first before getting on a call with a customer.

Internal Debt Collection Campaign Tips: What time of day is best to call?

Your customer has not paid after the final past due notice. It is now time to tackle a debt collection call to figure out when you will be receiving your money. While we often discuss best practice phone etiquette and provide sample call scripts, many clients have inquired about the best time of day to call their clients to get the best results.

While there is no specific time or magic solution for calling and reaching a happy client on the other end of the line, there are several best practices you should follow when calling.

Get to know the person you are calling

Not only do you need to know the specific person to call, but you should try to form a relationship with that person. Â If and when the client encounters financial troubles, you will have a deeper insight into their schedule. Keep notes on what business hours the person works, if they only work on certain days and any upcoming vacation time they will be taking. This could all provide helpful insight if you are calling their direct line and continually reaching their voicemail.

Call time can be influenced by business size

If your customer is a very small business, there is a potential that you could be in contact with the business owner instead of an accounts payable employee. If this is the case, try to call concerning collections early in the morning, around 7 a.m. Most business owners get to the office early to take care of business matters before being pulled into meetings. Remember, 7 a.m. is not a firm call time. It is always important to develop a relationship with the person you will be calling and use your judgment on whether a call before work hours is necessary.

First thing in the morning is better than end of the day

Collection calling is probably not the first thing on your to-do list that you want to do. Nevertheless, it is important to call early in the morning to reach people before they become busy with anticipated tasks and meetings. By calling in the morning you are more likely to get a same-day decision on a payment schedule, even if the client needs to contact you back later in the day.

What time of day is most successful for your business’s internal debt collection calls?Â

Five Tips for Making Collection Calls that Get You Paid

Debt collection calling is not the type of task most employees get excited about. Typically, in-house campaigns take employees out of their comfort zone. For most small businesses it is a task given to employees in addition to their normal job responsibilities. Don’t waste your time and money with an inefficient debt collection calling campaign. Instead, be successful from the start!

Here are the top five things to do when making collection calls:

Always prepare for excuses.

Unfortunately, most debtors will not be quick to offer payment options. Don’t allow yourself to get flustered by excuses. Instead, be prepared. Here are the most common excuses you will hear:

The check is in the mail.

How to respond: Ask for the date of the check, amount, address where it was sent and check number.

I never received the invoice.

How to respond: Always give the customer the benefit of the doubt. This is a great time to verify their preferred method for their invoice: email or mail. Always follow-up this discussion with asking how the customer will pay the past-due balance.

Our business is going through financial problems.

How to respond: Work to set up a payment schedule with the customer.

We completed the wire transfer yesterday.

How to respond: Ask for the routing and banking information. The customer could be telling the truth, but you need all of the information you can collect to verify the validity and make the most of the call.Â

Do your research before the call.

Learn as much about the customer as possible before picking up the phone. Common information to find out includes:

- Has the customer had payment problems in the past or is this uncharacteristic?

- Did the sales person have concerns about the account?

- Terms of sale

- Payment due date

- Exact amount due

Always be professional.

Never threaten a customer for payment. The goal of the collection call is not merely to successful collect payment; you should try to also maintain the business relationship if possible. When on the collection call, follow these tips:

- Never multi-task. Be completely focused on the call.

- Speak slowly and take more pauses when you speak.

- Never eat food, drink a drink or chew gum while on the phone.

- Go into the call with a positive attitude. Your tone and inflection of voice will mirror your attitude.

Ask open-ended questions.

You will never get paid if you only ask questions with Yes and No answers. Let’s look at a scenario:

Option A: Do you plan on paying us soon?

Option B: What date can I expect payment from you?

Option B is obviously the better choice. You are committing the customer to a specific date. Make it a goal to commit the customer to something before getting off the call: full payment, partial payment, or even a date that they can let you know their payment plan (Remember, sometimes your main point of contact does not control the money within the business.)

Be deadline-driven, but still flexible.

Debt collection requires you to walk a fine line. You need to be assertive, but not too pushy. Always emphasize the urgency of the matter and try to have the customer commit to dates for payment.

What Makes a Good Debt Collector?

As a business owner, your collection call team will lead you to increasing cash flow. But is a good debt collector born with “it†or taught “it� For small businesses and start-ups, finding the right person on the team is particularly important because often team members wear multiple hats; only needing to step into the role when needed.

As a business owner, your collection call team will lead you to increasing cash flow. But is a good debt collector born with “it†or taught “it� For small businesses and start-ups, finding the right person on the team is particularly important because often team members wear multiple hats; only needing to step into the role when needed.

We think the right person has a combination of the right personality traits and proper training. Don’t always go for the sales person or accounts receivable person on the team. While they may be directly related to the process, they may not have the personality needed to deal with potentially intense situations.

When considering a team member, look for the following traits:

-Â Â Â Â Â Â Â Â Â Problem-solver: Often driven to find a solution, the problem solver is going to approach the situation with unique ideas. They will be results driven, even if the debtor becomes upset during the process.

-Â Â Â Â Â Â Â Â Â Self-motivator: Getting on a call is nerve-wracking because the debt collector does not always know how the debtor will react. By having someone with a keen sense of self-motivation, they will be driven to get the work done.

-Â Â Â Â Â Â Â Â Â Tenacity: If a debtor is persistent with providing reasons as to why they cannot pay, the collector will need to be just as persistent to make sure that the call ends with an action item of next steps in the payment process.

And, provide the following training:

-         Selling: The debt collector on your team needs to be able to prove to the debtor that they must pay. This is very similar to a salesperson’s role. By providing the team member with proven tactics you can prepare them for the most challenging calls.

-Â Â Â Â Â Â Â Â Â Customer Service: While it may be a good idea to pick the most tenacious person on the team, they also need to have good customer service skills. Being too controlling during the situation could turn the customer off and lead to no payment. The ideal candidate would have a good balance.

Finding the right person on your team to handle debt collection calls goes beyond the ability to pleasantly interact with customers. It requires a combination of skills to be effective.

Do you have the right person for the job on your team?

6 Reasons Account Statements Can Keep Payments On Track

How can Account Statements keep money flowing?

Many businesses don’t send account statements, which is surprising. Most customers find statements helpful for keeping track of their own payments while serving as a reminder that a bill is coming due.

Many businesses don’t send account statements, which is surprising. Most customers find statements helpful for keeping track of their own payments while serving as a reminder that a bill is coming due.

As if that’s not enough of a reason, Account Statements can do even more:

1. Statements keep money flowing

Customers who use statements to check their own records can easily and quickly verify that the numbers are correct. The sooner they’re satisfied that everything is in order, the more quickly they pay when the bill arrives.

2. Statements highlight discrepancies

If the statement numbers don’t match up with your customer’s records, this will bring it to light early so you can avoid disputes altogether.

3. Statements keep you in the forefront

Receiving statements with your company logo and contact information helps to keep your business top of mind.

4. Statements plant seeds

Statements subtly tell your customer that you’re on top of things and that you expect them to be on top of it, too.

5. Statements provide excellent customer service

Account statements can be a real time saver for your customer. Not only are you providing an easy summary but your contact information is handy, too. Many customers come to rely on statements as a checkpoint each month.

6. Statements can eliminate the need for past due notices

They serve as a gentle reminder of money that is owed. It’s not a bill, so there’s no threat attached. And since statements can help to prompt payment, you’re likely to send fewer past due notices.

Consider adding account statements to your monthly routine. You may find that the added expense really pays off.

Easy In-House Debt Collection

Are your in-house debt collection procedures streamlined?

Do you have a process to follow that helps keep your past due accounts to a minimum? If your in-house debt collection policies could you some fine-tuning, C2C Resources can help.

It’s not uncommon for the task of debt collections to be neglected in a business. For one thing, it’s not pleasant to make a collection call so calls often get put on the back burner. However, if you have the right tools at your disposal for making calls and sending notices, the task of managing your Accounts Receivables can be less painful and considerably more effective.

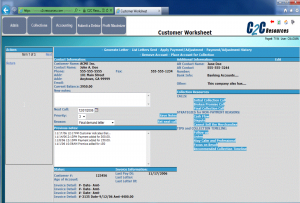

C2C Resources can help you manage collections in-house with its powerful Accounts Receivables management software system. Profit Maximizer is designed to help businesses keep track of the details throughout the debt collection process. It provides Contact Management, a detailed Reporting System, call scripts and collection notices that you can easily adapt for your needs. Simply fill in the blanks on the template and hit ‘send’.

C2C Resources can help you manage collections in-house with its powerful Accounts Receivables management software system. Profit Maximizer is designed to help businesses keep track of the details throughout the debt collection process. It provides Contact Management, a detailed Reporting System, call scripts and collection notices that you can easily adapt for your needs. Simply fill in the blanks on the template and hit ‘send’.

You can also sync with Quickbooks and input Excel spreadsheets with the click of a button.

As a partner, we provide our clients with everything they will need to manage accounts receivables in-house through our Profit Maximizer program. And there’s no extra cost to use this web-based program! When you partner with us, Profit Maximizer is yours and we offer support as you learn the system.

Experience the difference with Profit Maximizer! Check it out at C2C Resources.